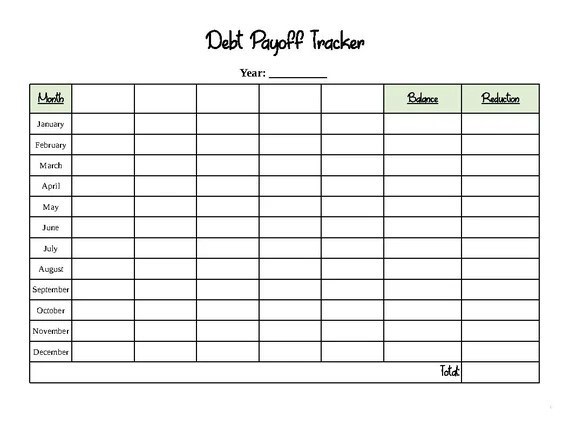

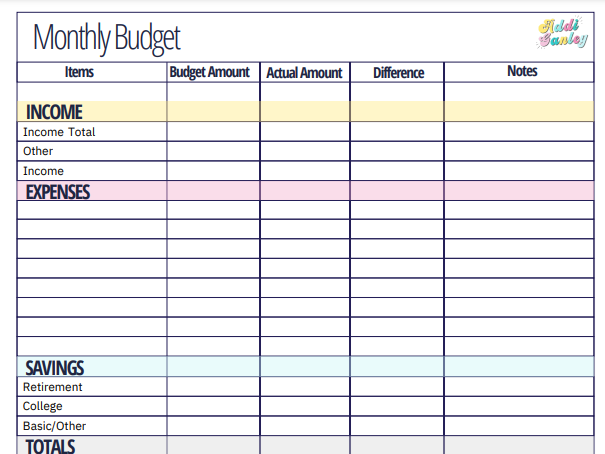

Description

Debt Repayment Trackers are digital tools designed to help users systematically pay off personal or business debts by providing clear, visual representations of repayment progress. These templates often come in Excel, Google Sheets, or printable PDF formats, and include automated calculations for interest, balances, and amortization schedules. Whether tackling student loans, credit cards, car loans, or mortgages, users can prioritize debts using strategies like the Snowball (smallest balance first) or Avalanche (highest interest first) method. These trackers promote accountability by encouraging regular updates and displaying motivational progress charts that reduce the stress and confusion associated with debt. Ideal for budgeters, families, and financial coaches, these tools foster discipline, build financial awareness, and help accelerate debt freedom goals. With features like color-coded payoff meters, total interest saved, and flexible customization, these trackers are perfect for users who want to stay committed and make informed financial decisions.

Sadia –

I love how easy it is to track progress. I even color in each milestone—it keeps me accountable and excited to pay off more!

Funmilayo –

This tracker fits perfectly into my digital planner setup. It’s clean, intuitive, and helps me stay laser-focused on becoming debt-free

Shafaatu –

I was overwhelmed with my student loans until I found this tool. Breaking it down visually gave me a plan—and peace of mind.

Livinus –

These trackers have been a game-changer in my financial journey. I finally feel in control and motivated seeing my debt decrease visually each month.

Chinedu –

The layout is simple but powerful. It helped me organize my credit cards, personal loans, and student debt in one place.